Why Competent Traders Still Break Their Rules

For professional discretionary traders, repeatedly violating a defined trading plan is a costly error that directly impacts P/L.

It shows up as avoidable losses, extended drawdowns, and failure to capitalise on the full expectancy of a trade.

Within institutional and professional prop firm environments, it doesn’t just impact the prospects of the individual trader. Execution instability becomes a system-level liability.

Across time and across desks, it increases realised volatility, deepens drawdowns, restricts capital scaling, and forces risk teams to tighten exposure.

Repeated plan violations are the visible symptom of a deeper pattern that activates under pressure.

These violations occur in traders who are technically competent, experienced, and operating with a clearly defined edge. At this level, execution instability is driven by psychological mechanisms that activate under exposure.

One key reason traders struggle to overcome execution instability under pressure is that they misidentify the root cause.

To fully resolve plan violations and restore elite-level consistency, the true causal and maintaining factors behind the behaviour must be understood with absolute clarity.

Only then can a solution be tailored to effectively restore performance.

The Common Misdiagnosis

When a trader fails to execute according to their defined plan, the behaviour manifests as one or more of a range of different violations such as;

- Hesitating on a clear A+ setup

- Sizing outside predefined risk parameters

- Letting a losing trade extend beyond the stop

- Cutting winners prematurely

- Overtrading to regain control

- Giving back a strong day or week

- Freezing or under-participating at increased size

- Drifting from defined playbook setups

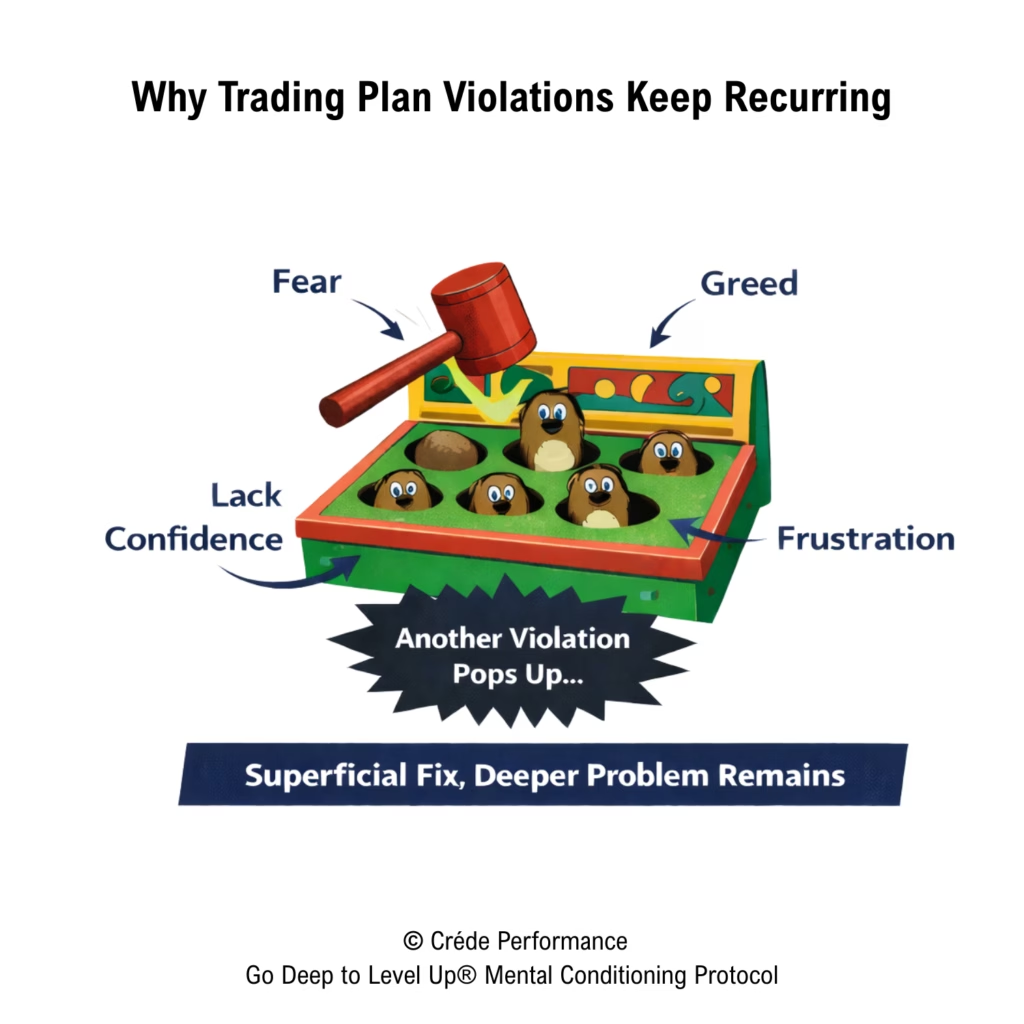

Typically, traders treat each plan violation as a separate problem. Hesitation to enter a valid trade is attributed to fear. Overtrading is attributed to greed. Cutting winners is attributed to a lack of confidence.

Each behaviour is isolated and assigned its own emotional label, and its own distinct fix.

This approach addresses symptoms, not the mechanism driving the inconsistency.

The problem with this approach is that it is akin to playing “whack-a-mole”. You attempt to fix the violation with a surface-level solution, but no matter how hard you work to resolve the issue, the next mole — the next instance of deviating from your process — is only moments away from rearing its head.

The violation can’t be categorically resolved because the root of the problem has never been addressed.

The Structural Reality

To comprehensively address trading plan violations, the lens needs to shift to conceptualising all psychology-driven violations of the trading plan as stemming from the same pattern of root causal factors. *

Applying this perspective to the Whack-A-Mole example, the root causal factor is that as long as the machine is switched on, the moles will keep appearing. The problem could be conclusively resolved by simply unplugging the machine.

What is often misunderstood is that each distinct type of trading plan violation is a behavioural expression of the same underlying issue — an interplay of subconscious and conscious programming. More specifically:

- Limiting subconscious programming that becomes activated under pressure;

- Combined with the person’s natural stress response;

- Magnified through conscious biases, cognitive distortions and behavioural habits that exacerbate the impact of the pattern.

To be very clear, it’s not that each trader has the exact same psychological wiring that expresses itself differently depending on the person;

It’s that every type of violation originates from the above three categories of factors combining to produce undesirable actions while trading.

To anchor this distinction in a clear trading example, consider the trading plan violation of trading with too much sizethrough the lens of this second explanatory perspective:

Example: Sizing Outside Predefined Risk Parameters

The trader holds a subconscious belief that “my self-worth depends on my external achievements”, which creates an internal drive to win at all costs.

After a series of losing trades, the trader starts to feel under more pressure. The threat is no longer financial. It becomes an identity-level threat. The trader is now at risk of a serious blow to their self-worth.

Physiologically, the nervous system moves into fight mode.

An “All or Nothing” lens takes over and reinforces the belief that a drastic solution is required to neutralize the threat. Risk parameters start to feel restrictive and negotiable.

The outcome? The trader increases size in a way that violates risk parameters in order to win bigger on the trade.

The Role of Mental Conditioning in Resolving Execution Instability Under Pressure

When trading plan violations are understood as being driven by this one root pattern, resolving deviations from the plan becomes a matter of mental conditioning.

Mental conditioning is the systematic training of the psychological mechanisms that determine how you execute under pressure.

It functions like a psychological gym program — personally-tailored, progressive, and built on defined mental skills and evidence-based performance techniques. Metrics are tracked to evaluate impact and refine the protocol.

Whether a trader is currently experiencing a repeated trading plan violation and wants to resolve it, or they are about to begin trading with higher size and they want to pre-empt any breakdowns in their psychology, the solution is the same:

Adopt a mental conditioning protocol to systematically optimize each of the three underlying categories of factors.

That is, optimize subconscious programming, resilience to pressure and conscious thought-patterns and habits, so that they all support the consistent execution of your trading plan.

Mental Conditioning is Not the Same as Traditional Coaching

Mental conditioning in trading is often conflated with traditional coaching. They are not the same intervention.

Mental conditioning is a structured, directive training process. Its purpose is not reflection for the sake of insight. The goal is behavioural stabilisation under pressure.

The practitioner identifies the psychological mechanisms driving repeated plan violations and designs a defined conditioning protocol. Sessions are purposeful and agenda-led. Insight is extracted only insofar as it informs training. The emphasis is on deliberate practice, repetition, and behavioural alignment in live market conditions.

Traditional coaching operates differently. It is typically exploratory rather than directive. Sessions are often guided by the trader’s immediate concerns, with the coach acting as a reflective counterpart. The objective is increased awareness, perspective, and self-understanding rather than deliberate retraining of execution behaviour.

Both approaches have significant value in supporting trading performance.

Coaching can expand awareness and support broader development and sustained behaviour change.

Mental conditioning targets the specific mechanisms that destabilise execution under pressure.

At the institutional level, they serve different functions, and can operate in parallel to amplify the impact on trading performance.

The Go Deep to Level Up® Mental Conditioning Protocol for Traders

Go Deep to Level Up is Créde Sheehy-Kelly’s proprietary mental conditioning protocol to help experienced traders resolve and prevent violations of their trading plan.

It is delivered in three formats:

- Go Deep to Level Up Your Trading™ — a self-paced online program for experienced, independent traders.

- 1:1 Performance Psychology Consulting — an intensive private container for professional discretionary traders operating at size. (Application required.)

- Scalable Firm-Level Deployment across trading desks.

Repeated plan violations do not resolve through insight alone. They resolve through protocol-based intervention.

Créde Performance applies the Go Deep to Level Up® Mental Conditioning Protocol within institutional and professional trading environments to restore execution stability under pressure.

Access to 1:1 consulting is by application.

*This framework applies to technically competent discretionary traders operating within a defined strategy and edge. It does not address skill deficiencies, structural flaws in a trading model, or deliberate strategic rule adjustments. It applies specifically to repeated, psychology-driven deviations that emerge under exposure.